From the basketball playoffs to the U.S. Open to the start of baseball season, spring and summer sports draw enormous crowds and countless spectators across the country. Earlier this year, the NBA All-Star Game drew an average of 7.8 million viewers alone, and last’s year’s U.S. Open set a new daily attendance record at 65 thousand fans. Meanwhile, brands are exceeding these numbers with their marketing dollars.

With so much opportunity—and competition—how can marketers stand out from the crowd and forge meaningful relationships with sports fans?

We’ve put together some best practices that will enable marketers to identify their perfect audiences and build lifelong relationships with super fans this season.

Meet Them at the Game

Marketers wanting to meet—and reach—sports fans may choose to sponsor sports content online or purchase expensive logos on advertising panels at stadiums. But what’s really the best way for brands to deliver their ads to sports-goers?

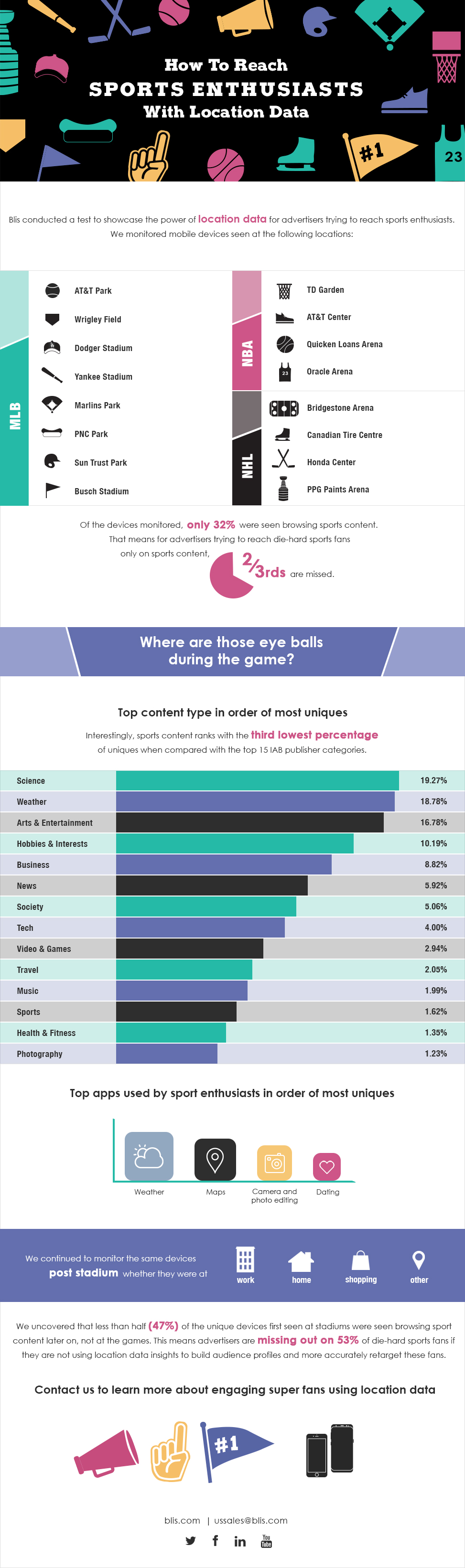

Even in 2017, the majority of digital advertising continues to be served via contextual targeting. Data from a custom Blis study shows that only 32% of sports fans browse sports-related content while at sporting events. This means that if marketers only focus on context-driven digital strategies, they’ll miss out on the opportunity to reach almost two-thirds of sports fans. Instead, these marketers would be wise to know that over half the fans visiting the Metlife stadium last year favored weather, entertainment, science & gaming content while at the game.

Moreover, ads appearing on stadium billboards might not lead to desired conversions like purchases or website visits. The Metife stadium, for instance, is sponsored by an insurance company, but how many football fans at the half-time show are signing up for insurance plans, let alone paying attention to the ads? And perhaps more importantly, will these fans see ads for that insurance company again after they leave the stadium?

Brands should see sporting events not only as the endgame of their marketing efforts, but also as the place to identify their ideal audiences—and begin forging meaningful relationships with them. Using sophisticated location data, brands can identify fans based on their mobile devices. Whether marketers geo-fence stadiums to collect device IDs, look at Wi-Fi check-ins or harness beacon technology, brands can build accurate pools of consumers who attended the big game.

But just knowing who went to the playoffs—and who came back for the finals—isn’t all location data can tell marketers; it can continue to provide important insights into each individual, including where they live, work, shop and where they like to go before and after the game—information that’s critical for retargeting.

Such data becomes even more useful when paired with other insights. By taking a look at demographic data and purchase histories, for instance, marketers can find out how much disposable income these fans have or how much they tend to spend around game time. Someone may be a diehard Yankees fan, but she can also be a mother-of-two who enjoys taking the kids to the mall after each ballgame. Such rich information will make it a whole lot easier for brands to craft effective, personalized marketing campaigns.

Reach Out at the Right Time

As any successful coach will tell you, timing is critical to success. Sports marketing is no exception. An alcohol brand would do well to target baseball fans in the hours before the first and after the last pitch as fans congregate in nearby bars before heading in and celebrate/drown sorrows before heading home.

Other brands may want to reach out to consumers after they’ve left the stadium. In these cases, marketers should continue to pay attention to location data. Again, it’s tempting for marketers to think it’s best to choose sports-related content to reach these stadium-goers long after the game. But our study reveals that less than half of sports fans (47%) seen at stadiums browse sports-related content after a game. In order to reach the remaining 53% of fans, marketers will need to learn more about them through other data sources, including historical location data, browsing histories and demographic data.

Paying attention to location means more than just targeting consumers at home or at a stadium; it also means paying attention to which devices consumers use and when. For example, the insurance brand can invite the sports fan to sign up for offers while he’s working on his desktop, where it will be easier to fill out a form, or smoothly stream a video via his home wifi.

Adidas recently launched a location-powered ad campaign designed to boost brand awareness and drive foot traffic to Intersport stores. The brand identified its target audience by collecting location data from soccer fields holding weekend league matches and pick-up soccer games. They then served video ads to these devices when they were at home connected to Wi-Fi. The campaign resulted in a 78% view-through rate and 5.5% increase in foot traffic.

Stay in Touch After the Championship’s Over

When brands go to the games, and stay in touch with fans wherever they go, they’ll be well-equipped to reach ideal audiences and build a loyal following. With location-based insights and advertising strategies, brands can make sure they win big on and off the courts this summer.

But the process of forging meaningful relationships with consumers extends well beyond the NBA finals or the U.S. Open championship. Brands must remain dedicated to identifying, understanding and reaching their ideal audiences, whether fans are getting ready to purchase their season tickets or pack up their jerseys till next year.